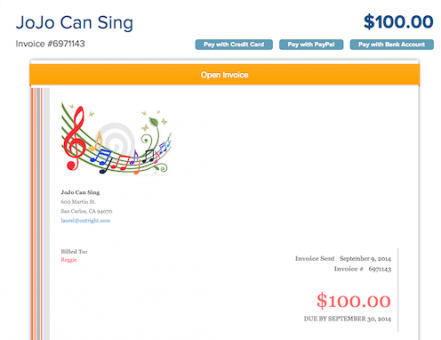

For GE investors, Chanos' short position is a warning sign The company has also recently announced a significant dividend cut, which has further eroded investor confidence. He believes that GE has overstated its earnings and has underfunded its pension obligations.In addition, the company has a large amount of debt and has struggled to generate revenue growth in recent years.Reasons for Chanos' Short Position on GE Concerns over accounting practices Underfunded pension obligations Large amount of debt Struggles with revenue growth Chanos is not alone in his skepticism towards GE.Other investors have also expressed concerns over the company's finances, and GE's stock price has fallen by over 30% in the past year. His insights have been sought after by investors and financial professionals worldwide.Why is he shorting GE shares?Jim Chanos, a well-known hedge fund manager, is widely regarded as one of the greatest short-sellers in the history of the stock market.His most recent target is General Electric (GE) and he has taken a significant short position on the company.But why is Chanos shorting GE shares?Chanos has expressed concern over GE's accounting practices and the company's financial health. Today, Jim Chanos is regarded as one of the most influential investors in the world.He is a frequent commentator on financial news programs and is often invited to speak at conferences and events.His investment philosophy continues to be based on a careful analysis of financial statements and a willingness to take calculated risks.Chanos is known for his sharp wit and his ability to identify potential flaws in companies' business models. The name "Kynikos" is a Greek word that means "cynical".The name reflects Chanos' contrarian approach to investing and his willingness to bet against popular trends and conventional wisdom.Chanos gained notoriety in the investment world for his successful short selling of Enron in the early 2000s.He was one of the first investors to publicly criticize the company's accounting practices, which eventually led to Enron's collapse. Chanos started his own hedge fund, Kynikos Associates, in 1985 Who is Jim Chanos?Jim Chanos is an American investor and hedge fund manager, best known for his short selling strategies in the stock market.He was born in 1957 in Milwaukee, Wisconsin, and graduated from Yale University in 1980 with a degree in economics.Chanos began his career on Wall Street in 1980 as an investment analyst at PaineWebber, and later moved on to work at Gilford Securities and Deutsche Bank. Jim Chanos, a renowned hedge fund manager with a successful track record of spotting financial frauds, has made a bold bet on General Electric Company (GE).Chanos has recently revealed that he is shorting GE shares, which means he is anticipating the stock price to plummet soon.This is alarming news for GE investors, who must be worried about their investments.But why is Chanos bearish on GE, and what does this mean for the company's future? In this blog post, we will explore these questions and analyze the potential implications of Chanos' skepticism on GE's stock valuation. I guess I'm about to learn to do this by hand.Billionaire investor Jim Chanos says short on GE shares CNBC So, I am going to be without a bookkeeping account after today. That way if the card is hacked, they have access to about $10. Our joint account, our joint savings, my business account and a fourth account that we transfer money to when shopping online. I refuse to give anyone, anywhere my login info to my bank account.

#ETSY AND AMAZON BUSINESS GODADDY BOOKKEEPING PASSWORD#

AND they wanted my login and password to hook me up. I never had my business account linked to GoDaddy.

If you don't add your banking info, you don't open an account. When I was signing up, QB force's you to add your bank account. Now, let me say that I will still be looking. and, if they try to contact me with important info with that number, and I can't get it, I'm kicked out anyway. Also don't want to be tied to my cell phone.

0 kommentar(er)

0 kommentar(er)